Strength in Numbers Toolkit

.png)

Toolkit Contents:

- Issue summary

- Talking points

- A shareable video that highlights the importance of the issue

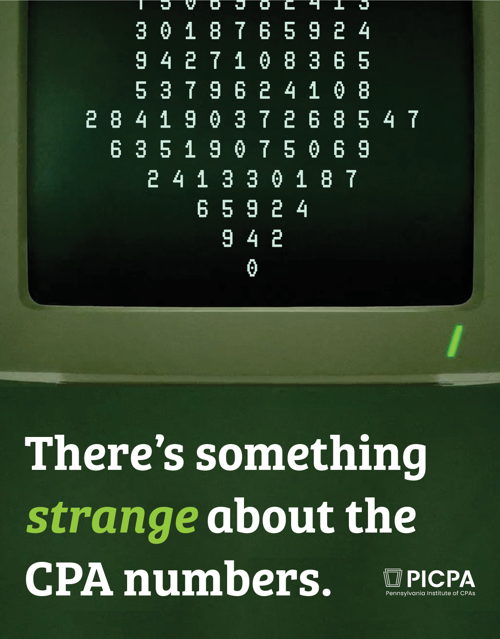

- Downloadable images for social media or other digital use

Issue summary

Increasingly complicated tax, financial and business laws and regulations have intensified the demand for certified public accountants but alarming numbers are nearing retirement while too few people are entering the field.

A new state law is needed to modernize and expand access to the CPA journey in Pennsylvania to meet the talent shortage.

Talking points:

CPAs are important to Pennsylvania because they:

- Guard our economy’s financial prosperity that we all rely upon.

- Provide strategic insight and guidance to bolster large and small businesses

- Help families make sound financial decisions

- Ensure the accuracy and integrity of financial statements that businesses and investors rely upon

- Keep state and local government agencies operating.

A massive retirement cliff combined with too few students studying accounting and sitting for the exam will create a continued CPA shortage.

- 75% of today’s CPAs working in public accounting firms will retire in the next 15 years.

- 7.8% decline in undergrad accounting degrees awarded between 2020 and 2022; 16.9% decline in accounting graduates from 2012–13 to 2021–22.

- In 2022, the number of candidates taking the CPA exam marked its lowest level in nearly two decades; 2016-2021 saw a 33% decrease in candidates sitting for the exam.

- 30% of CPAs in PA are 60 or older; 50% are 50 or older

The bill modernizes requirements by adding more accessible and cost-effective pathways for aspiring CPAs.

Reducing the cost and time required for education would open the profession to a broader range of individuals, allow them to enter the workforce earlier and fill the retirement gap.

The bill enhances CPA mobility by allowing the use of an out-of-state license to serve clients in Pennsylvania without additional licenses or fees.

The bill keeps the current licensure path but expands to include individuals who have:

- an undergraduate degree that includes specific relevant coursework

- two years of professional experience

- passed the CPA exam

The legislation maintains strict standards for entering the profession.

- The core concentration of relevant accounting and business content is required in all pathways.

- The integrity and quality of the license has been protected by upholding the critical content that prepares students to pass the exam and succeed in the workplace.

- Passing the CPA exam is required and is the capstone to licensure.

- The CPA profession has more continuing education post-licensure than most professions.

Ohio and Virginia already have enacted similar legislation. At least a dozen states will consider legislation providing either a new pathway to licensure and/or automatic mobility in 2025.

Shareable video:

This shareable video can be downloaded by clicking the arrow in the lower right-hand corner and then clicking the three vertical dots on the next screen.

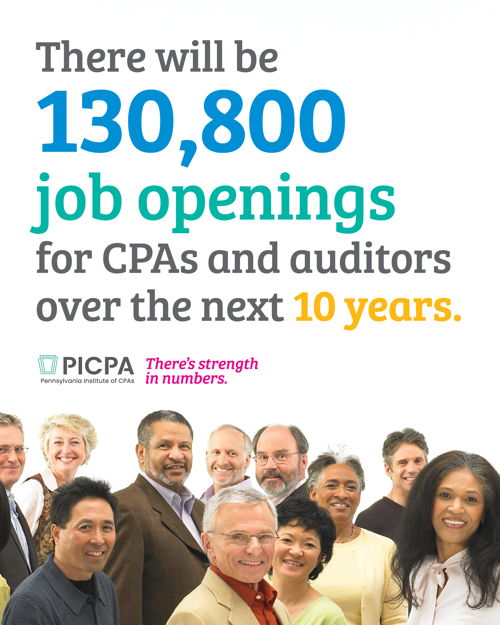

Downloadable images for social media or other digital use

(Click to download)

Suggested social media copy

- Too many jobs, not enough CPAs. They’re critical to economic and business success. Spread the word: The time is now to start the journey to becoming a CPA.

- Become more than just a number in our economy. PA businesses and families need CPAs to keep running but too few newcomers to counter a tidal wave of retirements. Consider starting the path to an in-demand career field.

- DYK in the next 15 years 75% of CPAs will be retired? Look into the pathway that has guaranteed job openings and keep our economy humming!

- Our economy depends on CPAs but there aren’t enough newcomers to fill a coming retirement gap – 75% of today’s CPAs will retire soon! It’s time for PA to modernize licensure pathways and replenish the talent pipeline with Senate Bill 719.

- Businesses, governments and families depend on the financial knowledge and integrity of CPAs but face obstacles with the growing shortage of newly minted CPAs. PA can keep its economic engine running with a new law to expand the pathways to becoming a CPA. Support Senate Bill 719.